Market Competition Pattern of Chinas New Chemical Materials Industry in 2021

2022-01-08

HUACHUANG

China's new chemical materials industry started late but developed rapidly. At present, the international competitiveness of local enterprises in the new chemical materials industry is relatively weak, and they are under great pressure from competition from overseas enterprises. At the same time, the product structure and core technical problems of the industry still need to be solved urgently; due to the regional industry Guided by the influence of policies, the industry presents a regional cluster development trend.

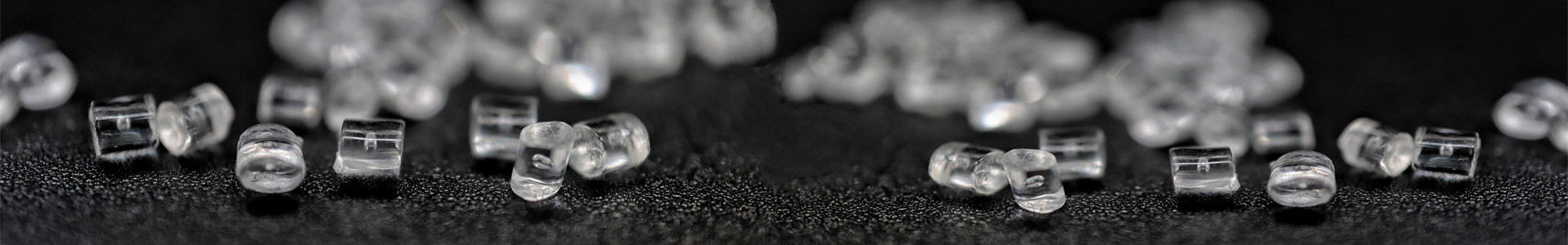

New chemical materials involve many new material fields such as organic fluorine, organic silicon, energy saving, environmental protection, electronic chemicals, inks, etc. It refers to the current development and development that have excellent performance or some special function that traditional chemical materials do not have. of new chemical materials. As an important part of the new material industry, the chemical new material industry is a more dynamic and potential part of the chemical industry.

During the "Thirteenth Five-Year Plan" period, the industry has developed rapidly, and the shortcomings of some industries have been supplemented. At present, China's new chemical materials market presents a situation in which the overall competition pattern is slack and the monopoly of local leading companies is parallel, and the international competitiveness of local enterprises is weak. Prospective analysis summarizes the development plans of various provinces and cities on the "14th Five-Year Plan" for the chemical new material industry, and believes that the regionalization trend of industry development will continue in the future.

Major listed companies in the chemical new material industry: Qixiang Tengda (002408), Huitian New Materials (300041), Silicon Treasure Technology (300019), Hongda New Materials (002211), Juhua (600160), Yongtai Technology (002326) ), Polyfluoride (002407), Xinan Co., Ltd. (600596), Tiansheng New Materials (300169), Wanhua Chemical (600309), Kingfa Technology (600143), Zhongtai Chemical (002092), Shanghai Petrochemical (600688), Xinjiang Tianye (600075), Huayi Group (600623), Sinochem International (600500), Daqing Huake (000985), etc.

The core data of this article: the technological development of international chemical new material enterprises, the regional distribution of large-scale enterprises in China's chemical new material industry

1. Competition characteristics of China's new chemical materials industry

China's chemical new material industry started late but developed rapidly. Local supportive policies and guidance documents have promoted the industry's rapid development and the regional division of labor has gradually become clear. Benefiting from regional advantages, the concentration of some sub-sectors has been continuously improved, forming a leading monopoly pattern However, due to factors such as weak industrial foundation and technical barriers, the core technology and general technology support of China's chemical new material industry is still relatively lacking, and the leading multinational groups in the foreign chemical industry have a greater impact on local enterprises.

2. Competitive landscape of new chemical materials industry

——Competitive landscape of global new chemical materials industry

As a sub-industry of the new material industry, the current global chemical new material industry has formed a three-tier competition pattern, and the development of each country's industry has its own strengths. The first echelon is the United States, Japan, Europe and other developed countries and regions, which have absolute advantages in terms of economic strength, core technology, research and development capabilities, and market share. The second echelon is South Korea, Russia, China and other countries, and the industry is in a period of rapid development. The third echelon is Brazil, India and other countries.

From a global perspective, the monopoly of the chemical new material industry has intensified, and the technical barriers to high-end materials have become increasingly apparent. Relying on the advantages of technology research and development, capital, talents, etc., large multinational companies have taken the leading position in most high-tech, high-value-added new material products with technology and patents as barriers.

——Competitive landscape of new chemical materials in China

China's chemical new materials industry is mainly divided into three competitive echelons.

The first echelon is foreign-funded (including Taiwan-funded) enterprises, which have rich industry experience, complete industry foundation, generally large-scale installations, high technical level, strong sales ability, relatively matched product chain, clear strategy and standardized operation. High-quality basic products and modified products occupy the high-end and middle-end markets, so they are often market leaders and gain relatively large profits.

The second echelon is dominated by large state-owned enterprises, with a small number of small and medium-sized state-owned enterprises affiliated to Sinopec Group. This echelon of enterprises entered the market earlier, has accumulated certain industry experience, has a complete industry foundation, a certain scale of installations, and has strong technical accumulation and The talent pool, product chain is relatively complete, operation and management are standardized but the mechanism is inflexible. Most products enter the mid-end market, some products are still at the low end, and the profits obtained are not stable enough. Some enterprises are still suffering from the disadvantages of traditional state-owned enterprises to a certain extent. troubled.

The third echelon is dominated by private small and medium-sized chemical enterprises, whose industry foundation is weak, the scale of equipment is small, the technical level is generally not high, the product chain is incomplete, the operation is flexible and changeable, sensitive to market changes, short-term behavior, and entering the market. Fast, a few large-scale and strong technical foundations are in the low-end market for basic products, while most companies are located in a broad and fragmented market for end-products. Some enterprises in this echelon are highly speculative, enter the market quickly when profits are high, participate in sharing high profits, and exit immediately when profits are low; some enterprises survive under the protection of local government policies, using low-priced resources or energy, ignoring environmental protection and Irregular behaviors such as quality, flexible marketing and lower labor costs for low-cost price competition.

It is worth noting that some large and medium-sized enterprises with certain competitive strength and relatively standardized operation have grown up among private enterprises. Some companies have great potential for rapid growth through joint ventures or strategic alliances with first-tier foreign companies. A small number of large and medium-sized private enterprises have begun to pay attention to the medium and high-end markets for basic products of new chemical materials and modified products, and are implementing large-scale project investment.

3. The competitive development trend of China's chemical new material industry

According to the data of China's new material industry development plan during the "14th Five-Year Plan" period, 154 new material industry bases have been established nationwide. The distribution of enterprises is dense, there are many scientific research institutes, and supporting elements such as funds and markets are highly concentrated. However, the overall technical level of the industry is high. Not high, too many primary products, unstable quality of intermediate products, lack of advanced products, far from meeting the needs of economic development. Combined with the regional distribution data of Qichamao enterprises, China's key chemical new materials enterprises are mainly distributed in Shandong, Jiangsu, Zhejiang, Guangdong and other regions.

The forward-looking analysis believes that although from the perspective of development, regionalization construction has a positive impact on highlighting key points, unified management, and reducing costs, but from the perspective of competition, regionalization development will intensify competition in specific regions.